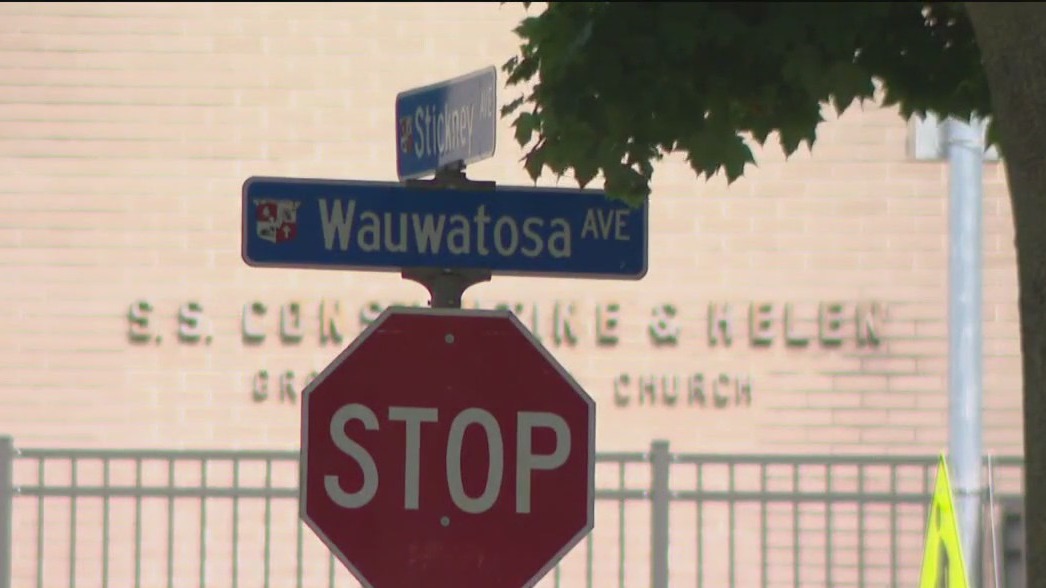

WAUWATOSA, Wis. – Some property assessments in Wauwatosa are going manner up.

What we all know:

Town assessor’s workplace mentioned, on common, homeowners are seeing a greater than 50% increase. Some homeowners say they have been shocked once they bought their assessments, and so they’re making an attempt to battle it.

It could be good to listen to your property has gone up in worth, however when Bob Gorman noticed his evaluation increase by greater than 50%, he could not imagine it.

FREE DOWNLOAD: Get breaking news alerts in the FOX LOCAL Mobile app for iOS or Android

“It’s simply fairly a leap for it to go up this a lot,” Gorman mentioned. “It’s nice the home goes up in value, however that’s not going to assist with the property taxes.”

He headed into the assessor’s workplace to determine what this meant for him.

“How’s that going to have an effect on the entire quantity of tax we now have to pay?” he requested.

By the numbers:

The assessor’s workplace mentioned, on common, Wauwatosa property homeowners noticed an evaluation increase of 54%. The workplace accomplished a revaluation this 12 months and reviewed all property assessments, taking a look at present actual property and market circumstances.

The final time that occurred was six years in the past.

Kim Casey mentioned she was ready for an increase after bettering her house, however understands others’ frustrations.

“So, we knew, however it nonetheless was like, ‘whoa,’” Casey mentioned. “I really feel unhealthy for individuals who aren’t ready or any person who’s at this level on a hard and fast revenue, and so they don’t have the bandwidth for it.”

Town assessor’s workplace mentioned you may count on to see an increase in property taxes in case your evaluation went extra up than common and will go down if it is much less.

Native perspective:

Gorman, like so many others, is now making an attempt to determine what to do subsequent.

SIGN UP TODAY: Get day by day headlines, breaking information emails from FOX6 Information

“My spouse and I are retired, so we’re making an attempt to determine if the worth of the home went up that a lot,” he mentioned. “How’s that going to have an effect on the general property tax invoice?”

The assessor mentioned the workplace is experiencing a excessive variety of calls and emails and is responding within the order it will get them.

What you are able to do:

If you wish to work out what this implies to your property taxes, you should utilize the city’s Property Tax Calculator.

The Supply: The data on this publish was collected and produced by FOX6 Information.